Nov 3, 2020

Bond Investors Reap Ivory Coast Returns Despite Election Strife

, Bloomberg News

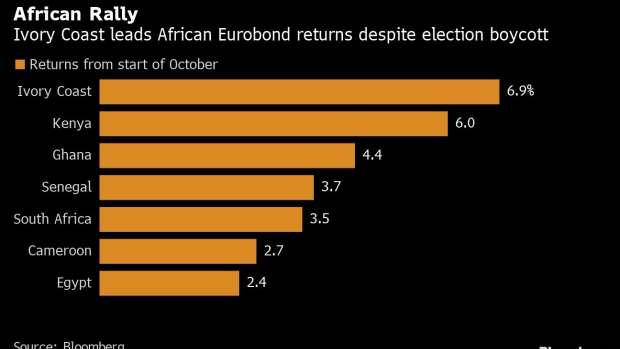

(Bloomberg) -- Ivory Coast’s Eurobonds are handing investors the best returns in Africa even though the nation is embroiled in a disputed election.

The dollar notes of the world’s top cocoa producer have returned 6.9% since the beginning of October, according to data compiled by Bloomberg. That’s the most among peers on the continent and second-best in emerging markets after Belize, which returned 7.5%.

Ivory Coast President Alassane Ouattara secured a landslide victory in elections that the main opposition asked their supporters to boycott, arguing his bid for a third term was unconstitutional. Investors appear confident Quattara’s government will maintain policies that helped fuel annual economic growth of at least 7% since 2012, his first full year in office.

“The market is sending a clear message that despite the kind of unrest we’ve seen during this election and the opposition perspective, it won’t lead to large-scale violence,” Kobi Annan, an analyst at U.K. and Ghana-based Songhai Advisory, said by phone. “People may not be in favor of a third-term for Ouattara but they’ve shown that if his continuation in power means political and economic stability they will follow that.”

Yields on Ivory Coast’s $2.5 billion of 2032 Eurobonds dropped for a fourth day on Tuesday, declining six basis points to 6.08% by 11:37 a.m. in London. They’ve plunged 115 basis points since the start of October.

©2020 Bloomberg L.P.